The fintech boom (technology to automate financial services) and the opening of the main social media platforms so that content creators can charge for their content, are technological development trends that do not reach Nicaragua, due to the fact that the country’s financial system does not have the necessary interconnectivity to develop these processes.

The lack of such interconnectivity has represented a problem for years for content creators in Nicaragua -of any kind-, added to the low financial profitability of a country with such a contracted economy as the Nicaraguan one.

All these factors form a kind of technological and financial “perfect storm” that, as a technology expert said, turn Nicaragua into a kind of “black hole for content creators”.

Becoming a personal brand

A well-known content creator on condition of anonymity, told DIVERGENTES that the difficulty of receiving payments from social media platforms or through fintechs, limits the ability to earn more from the created content.

“In being an influencer or content creator, whether it is humor or any other type of content, what helps you in Nicaragua is to create a personal brand with which you can compete in the national market to get a company to choose you to advertise their product. That’s the real source of income you can have, it’s not the Internet as such,” he acknowledged.

The X, formerly Twitter, membership program, developed so that content creators can create exclusive material for the platform and earn money in the process, does not include Nicaragua, being the only country in the Central American region with this status. This leaves content creators in the country out of this initiative.

Facebook and Instagram cannot make direct payments to content creators in Nicaragua, and the direct advertising format is not working in the country either.

Onlyfans boom doesn’t reach Nicaragua

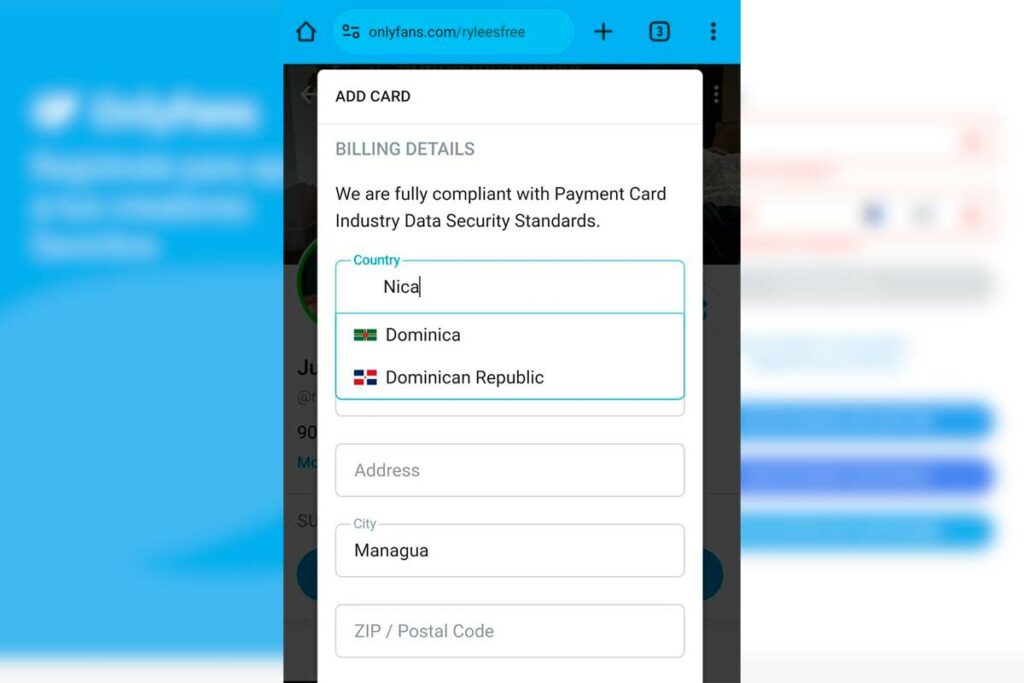

Onlyfans, a platform for erotic content that even allows the distribution of exclusive content to individual subscribers who pay for the service, cannot be activated in Nicaragua, neither by those who want to subscribe to it nor those who want to provide a service through the platform. Or, at least, they cannot do it using credit cards or bank accounts of the National Financial System ( NFS).

These content or subscription platforms are the ones that content creators can earn money from with the help of fintech sites such as Paypal, Stripe, Payoneer and Wise.

However, Stripe, Payoneer and Paypal do not allow direct transfers of funds from these platforms to bank accounts in the NFS.

In the case of Wise, it can be linked, but with several cuts in transfer fees.

“That’s a problem with the local financial system. You have to connect all these platforms like Paypal or Stripe to the financial system so that they transfer your funds to your bank account. For that there has to be a connection system with the banks, or at least a bank of the national financial system, to define what we can call a ‘gateway’ so that the payment of the contents can be carried out”, explained an expert in technological issues, who asked not to be named due to the repressive context in Nicaragua.

“Nor is it very attractive for the platforms to make these investments in countries like Nicaragua, when the creation of content is not so profitable or constant. It is not that a large number of people are engaging in that in Nicaragua, at least at levels that are profitable or attractive to payment platforms,” he added.

Customs surveillance of debit cards

A direct consequence of these restrictions is the regime’s control through the General Directorate of Customs (DGA), which confiscates the debit cards that U.S. companies send to Nicaragua to carry out transactions through payment platforms.

These cards, which arrive in Nicaragua through international courier services, are not delivered directly to their recipients who work for U.S. companies. What happens is that Customs officials open the envelope, check the card, record the data of its owners, and then notify them to pick it up at a Customs office.

When the user arrives to pick up the card, they are subjected to interrogations by Customs as to the nature of the company they work for and whether they have any background or links to any political activity in opposition to the dictatorship.

Due to these restrictions, the only platform that still continues to issue debit cards to deposit payments for content creators or collaborators of U.S. companies in Nicaragua is Payoneer, which sends them to the country, but not before going through the procedures established by Customs.

Nicaraguan banks do not meet requirements

Manuel Díaz, digital marketing consultant and creator of the renowned portal Bacanalnica, explained that the main problem for the development of fintechs is that the NFS does not meet the requirements and regulations established by payment platforms to operate in the country.

“There are no restrictions against this type of platform or transactions. It is the other way around. These platforms need certain requirements and Nicaragua does not meet them. That is why they do not operate in the country. These platforms operate on top of a financial structure that requires certain requirements to operate,” Diaz said.

“Paypal, which is like the unofficial currency of the Internet, does not work. You cannot transfer money from your Paypal account to a Nicaraguan bank account, because Nicaragua is in a group of countries where the risk is very high, for not having the requirements to sustain that financial infrastructure, which in turn, makes it easier for these platforms to send money”, he added.

The dictatorship’s surveillance is not related to the problem

Díaz ruled out that the context of political surveillance and the de facto police state imposed by the dictatorship is a major factor in dissuading payment platforms from establishing connections with Nicaragua.

Opponents and human rights activists have denounced that the dictatorship has used Law 976 or Law of the Financial Analysis Unit (UAF) and the regulation of Law 977 or Anti-Money Laundering Law, to monitor bank money movements of targets of interest or even order the freezing of bank accounts.

The UAF has the power to receive and request suspicious transaction reports, as established in Article 5 of Law 977 and endorses banks that “under no circumstances” disclose to a client, associates, employees that information about them was sent or any alleged criminal investigation is being developed.

“It has nothing to do with it. This surveillance environment does not help, but the reason, I insist, is that the financial system does not meet the necessary standards. These things that do not go beyond what directly happens to account holders who are victims of surveillance and repression, do not transcend beyond Nicaragua and the repudiation of these acts,” said Díaz.

Nicaragua lacks options for content creators

Unfortunately, this scenario is the main reason that determines how unfeasible it is for a content creator in Nicaragua to live exclusively from its digital content production, despite the various existing alternatives to receive monetary contributions available on the network.

“They should be able to earn money through direct advertising in Nicaragua, but that has disappeared. There are a few influencers there who make some tiny amount of money for advertising some product, but that’s it. To think that someone is going to survive by creating content on the Internet is a lie,” said Diaz.

“There are not enough views in Nicaragua to make it attractive for YouTube advertising and there is no longer the option of direct advertising, which would be the real source of money, so we are screwed. Nicaragua is a black hole for content creators,” he said.